124

Chapter 3: Measures of Variability

Example 3-12:

Different brokers charge different amounts of fees to

manage an investment portfolio. An investor shopped around to get an idea

of the fees which will be incurred to manage two portfolios of stocks. He

found that the average monthly fee for (Portfolio A) was $275.00 with a

standard deviation of $65.257. Another portfolio of stocks (Portfolio B) had

an average monthly fee of $50.125 with a standard deviation of $15.525.

Compare the variations of the fees for the two portfolios. Assume the

portfolios of stocks represent the samples.

Solution:

(portfolio A) =

%73.23 %100

275

257 .65

(portfolio B) =

%97.30 %100

125 .50

525 .15

Since the

is larger for Portfolio B, then one could infer that there is more

variability in the fees charged by different brokers to manage Portfolio B.

Next we will discuss the population coefficient of variation.

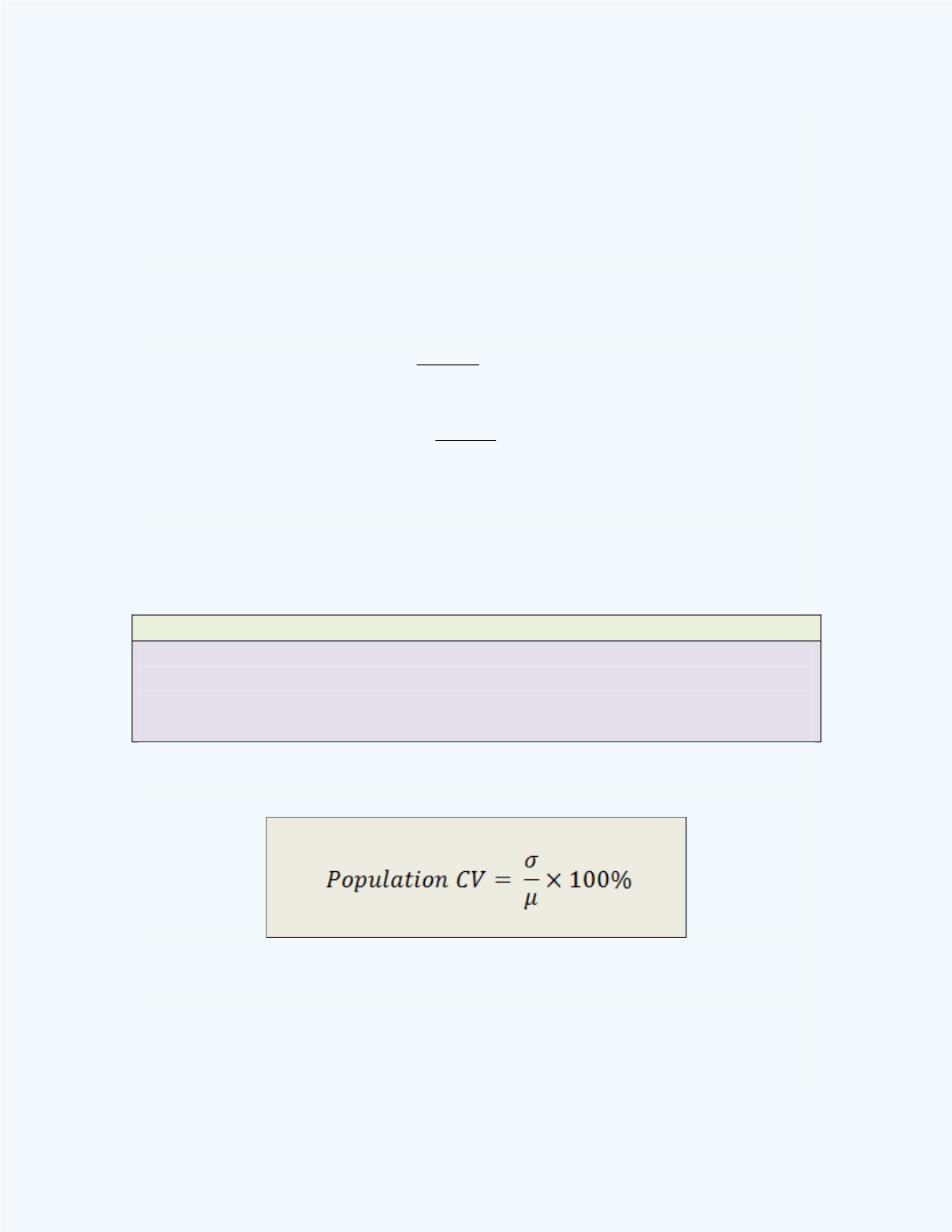

Definition: Population Coefficient of Variation

The population coefficient of variation is defined as the population standard

deviation divided by the population mean of the data set.

The formula used to compute this parameter is given next.

Note:

The population

has the same properties as the sample

. That is,

the population coefficient of variation standardizes the variation of the data

set by dividing it by the population mean. Thus the coefficient of variation

has no units, and so we can use this measure to compare variations for

different population variables with different units.