138

Chapter 3: Measures of Variability

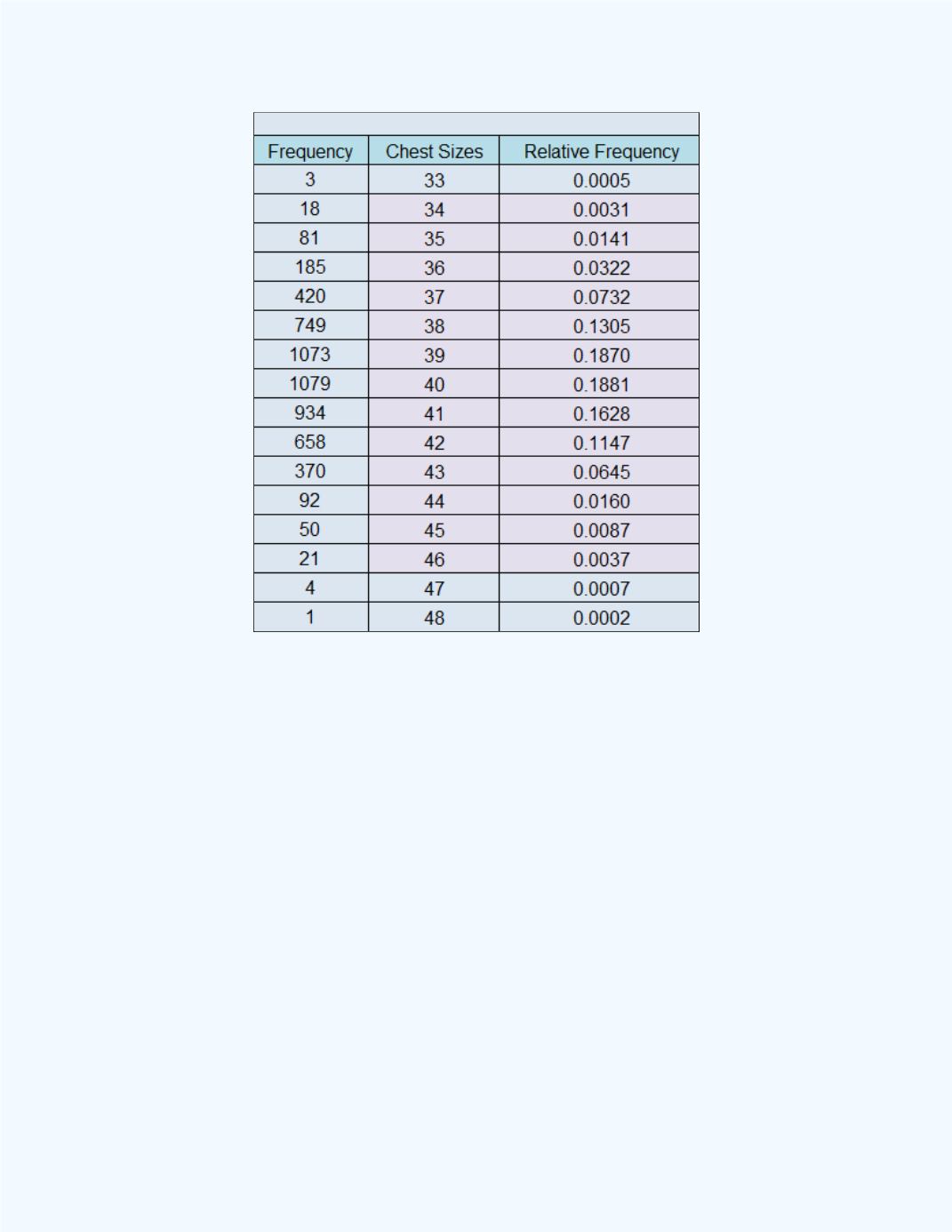

Figure 3-28:

Computed probabilities

to be included

for the Three-sigma rule for the Chest Size

data

Example 3-15:

A portfolio of Internet stocks had an average cost per

share of $46.20 with a standard deviation of $10.11. If the distribution of

the data is bell-shaped, what interval will contain approximately 95 percent

of the stock prices?

Solution:

Using the two-sigma rule, 95 percent of the data will be included

in the interval of $46.20 ± 2

$10.11= $46.20 ± $20.22. The lower limit of

the interval is $46.20 - $20.22 = $25.98, and the upper limit of the interval is

$46.20 + $20.22 = $66.42. Thus, 95 percent of the stock prices should fall

between $25.98 and $66.42.