Chapter 8: Discrete Probability Distributions

319

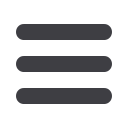

Table 8-8:

Probability Distributions for

Portfolios A and B

Solution:

Let the profit for portfolio A be represented by the random

variable

X

, and let the profit for portfolio B be represented by the random

variable

Y

. Then,

E(X) =

(-1000)

0.2 + (-100)

0.1 + 300

0.4 + 1,500

0.2 + 2,500

0.1

= $460.

E

(

Y

) = (-2,000)

0.2 + (-500)

0.1+ 1,800

0.3 + 2,000

0.3 + 3,500

0.1

= $1040.

Since,

E

(

Y

) >

E

(

X

), you should invest in portfolio B based on the expected

profit. That is, in the long run, portfolio B will out perform portfolio A.

Thus, under repeated investments in portfolio B, you will, on average, gain

$(1,040 – 460) = $580 over portfolio A.

Section Review

e-Self Review